Narayana Murthy gives his 4-month-old grandson shares in Infosys valued at Rs 240 crore: What is the Indian gift tax system?

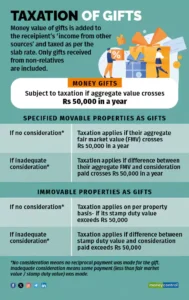

Gifts from family members are not taxable under the Income Tax Act. Inheritances and gifts from a spouse or from a will are not subject to taxes. However, if the total value of gifts from non-relatives above Rs 50,000 per year, they are subject to tax. The cap applies to cash and movable property separately.

Ekagrah Rohan Murty, the four-month-old grandson of Infosys founder NR Narayana Murthy, received shares in the company valued at about Rs 240 crore, according to a Moneycontrol story.

Although all the specifics of this share transfer are unknown, gifts are taxable in some situations, just like any other type of income. However, there are instances in which donations might not be subject to taxes.

The Income Tax Act’s Section 56 outlines how gifts are currently taxed in the recipient’s hands.

Presents of cash, real estate, and certain moveable assets received from non-family members in exchange for little or no consideration are all considered presents (see table). These are valued at “income from other sources” and are subject to taxation based on your applicable income tax bracket. Should the gift be intended for a minor, the tax liability rests with the parent or legal guardian.

Money: Taxation only becomes applicable if the total amount of money you get as a gift—cash, check, etc.—exceeds Rs 50,000 annually. No tax is applied below this threshold.

Hence, you will be taxed on the full amount of money, not simply the excess of Rs 50,000 (Rs 25,000), if you receive gifts totaling Rs 75,000 in a given year.

Moveable property: If, over the course of a year, you obtain any specific moveable properties for no consideration (that is, you do not receive a reciprocal payment for them), and their total fair market value is more than Rs 50,000, you will be liable for tax on the full amount. For example, if you acquire paintings and jewelry totaling Rs 20 lakh in a year, the full sum will be subject to tax since it is over the Rs 50,000 threshold.

If you receive specific movable properties for less than adequate consideration, meaning you pay a reciprocal amount for them, you will be required to pay taxes on the difference between the properties’ total fair market value and the consideration you received, provided that the difference is greater than Rs 50,000. For instance, you will owe Rs 8 lakh in taxes if you receive jewellery and artworks valued at Rs 20 lakh over the course of a year and pay a total of Rs 12 lakh for them.

Keep in mind that taxes only apply to the following types of movable property: bullion, shares, securities, jewelry, archaeological collections, drawings, paintings, and sculptures, as well as virtual digital assets like cryptocurrency.

Immovable property: The full stamp duty value, which is the government’s assessment of the property worth, is liable to tax if you obtain any immovable property (land and/or building) for free consideration (no reciprocal payment is made) and the value exceeds Rs 50,000. Therefore, the whole amount of taxes will be applied if you get a property as a gift that has a stamp duty value of Rs 10 lakh.

The gap between the consideration paid and the stamp duty value is subject to taxation if it surpasses Rs 50,000 and you get any immovable property for insufficient consideration (some reciprocal payment is made). In the event that you receive a property valued at Rs 25 lakh after paying Rs 10 lakh in stamp duty, you will be required to pay tax on Rs 15 lakh as a gift.

It should be noted that the Rs 50,000 annual limit (per gift) applies to the total amount of gifts received in a given year for both monetary and moveable property gifts. However, the Rs 50,000 cap is applicable to each real estate transaction in the case of immovable property. Therefore, no tax is due if you get several properties as gifts in a year and none of them exceed the Rs 50,000 cap.

when there is no tax on gifts

Taxation only kicks in in any of the aforementioned situations when gifts from non-relatives over the Rs 50,000 threshold (applying separately for money gifts, mobile properties, and immovable property).

Presents from family members are not taxable under the Income Tax Act, regardless of their monetary worth. However, who qualifies as a “relative”? Let us consider a pair, H and W. a) H’s spouse; b) H’s brother or sister; c) W’s brother or sister; d) H’s parents’ brother or sisters; e) any lineal ascendant or descendent of H or W; and spouses of b), c), d), and e). is considered H’s family.

Blood relatives like parents, grandparents, and great-grandparents are examples of lineal ascendants, and children, grandchildren, and so forth are examples of lineal descendants.

Presents given as part of a marriage vow, under a will, or as an inheritance are also exempt from taxes. Keep in mind that the only circumstance when gifts are not taxed is during a marriage. Any other occasion-specific gifts are taxable.

In addition, the exemption also applies in situations where any sum is received from charity trusts and institutions (as defined by sections 12A, 12AA, and 12AB) or from specific funds, foundations, educational and medical institutions, etc. (as stated under section 10(23C)).